Another volatile day in the Market.

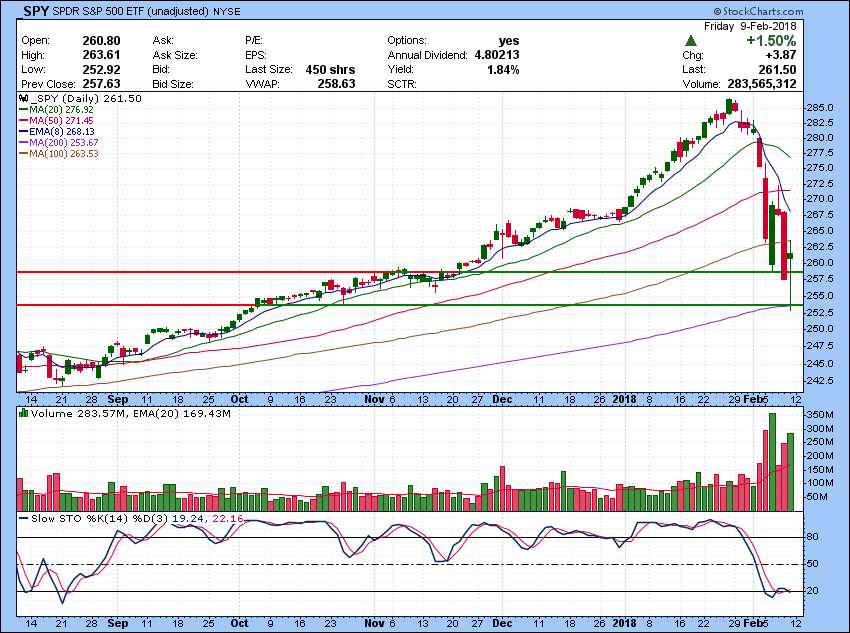

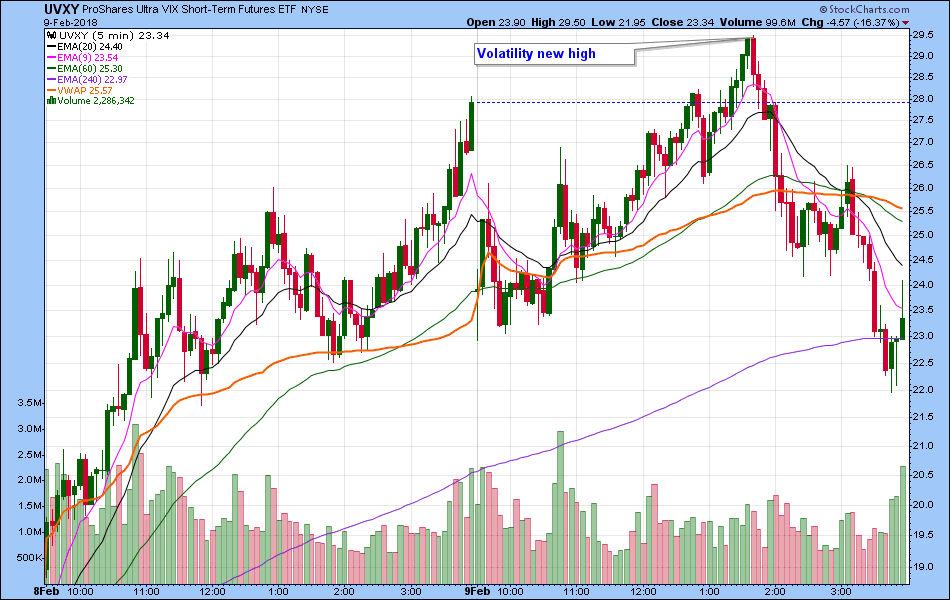

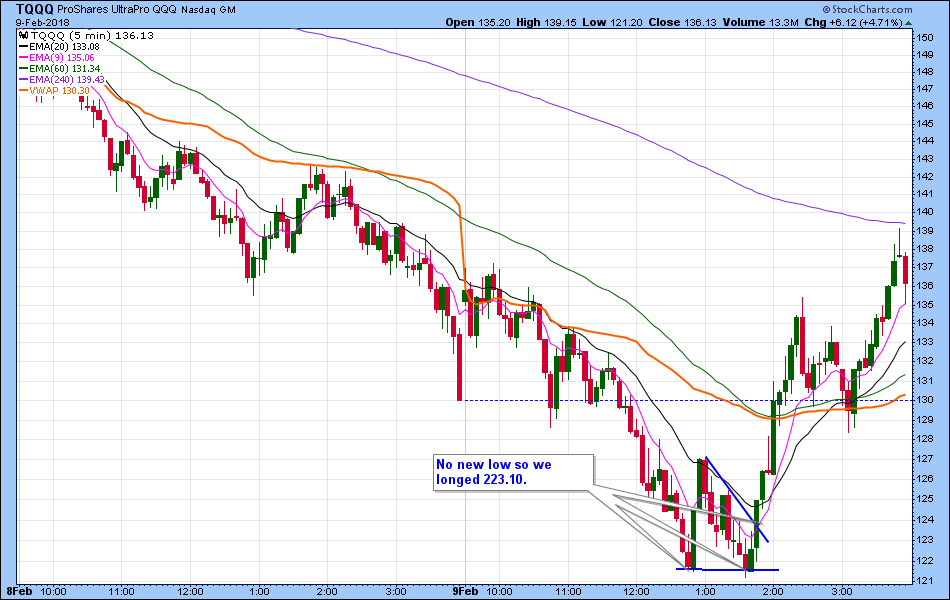

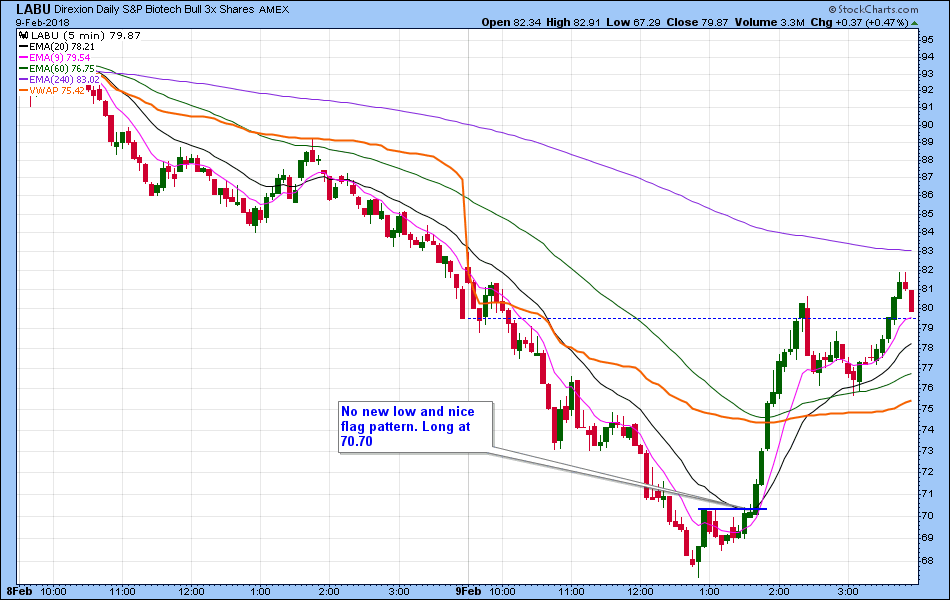

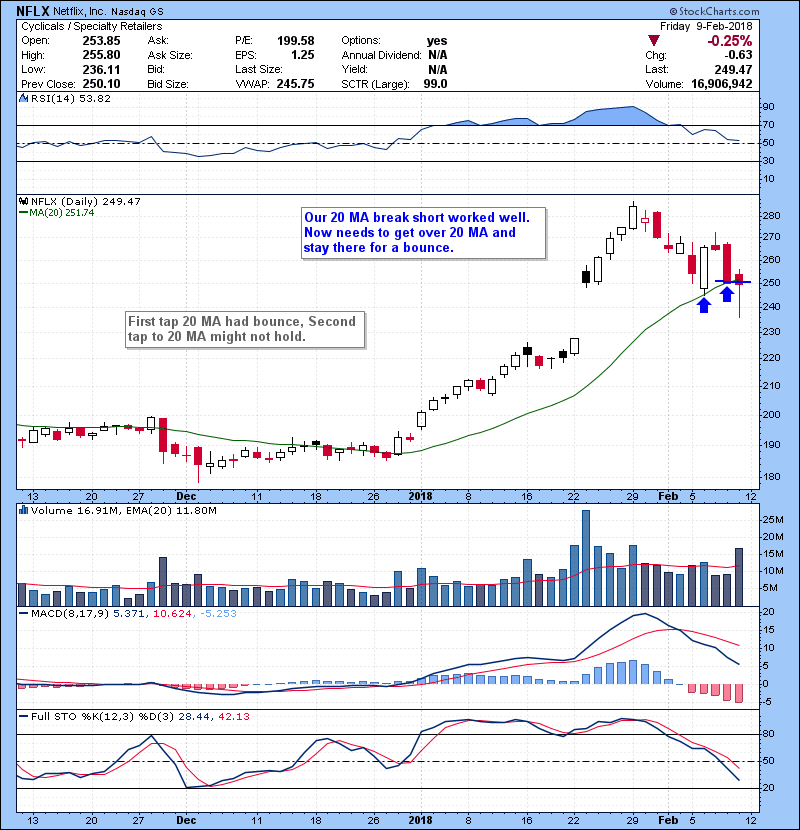

I wrote about another shake out and finally we had that shake out. SPY opened higher, failed 100 MA resistance then went below our 258.60 level, broke 200 MA , took out some stops and then an expected sharp bounce. Our game plan from blog worked out well, watch list names like SQ,NFLX ,WYNN gave nice short opportunities. UVXY gave a quick red to green play. If you follow me on Twitter, we also caught the bounce via $TQQQ, $TNA, $LABU. While $UVXY was making new high, technology ETF, biotech XBI was not making any new low, creating what's called a divergence. Often time divergence crates powerful reversal of trends, so we basically bought basket of ETF's via $TQQQ, $TNA, $LABU . Check out the bounce trades from Friday below.[caption id="attachment_48364" align="alignleft" width="950"]

Volatility UVXY making new highs.[/caption][caption id="attachment_48366" align="alignleft" width="950"]

Technology ETF no new low and a double bottom look.[/caption][caption id="attachment_48365" align="alignleft" width="950"]

Biotech ETF, no new low and a nice flag.[/caption]So 200 MA on SPY now major support and 100 MA resistance. Bulls needs work on a few day of bounce and test some overhead MA/price resistance here in an oversold market. Given how violent this correction has been it is hard to say that Market has seen the lows, "V" shape bounce has been replaced with "V" shape correction. But few days of bounce would sure be nice. I am mostly sticking with trading ETF's now,awesome range on those in a volatile market and they are 1st one to fall and rise.

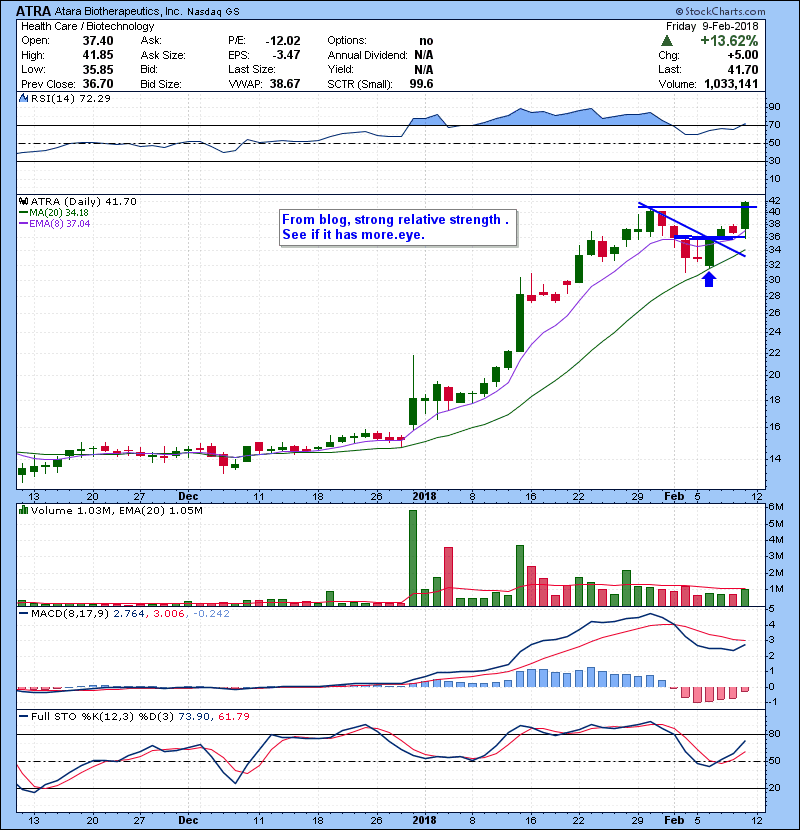

If you are struggling with your trading or learn how to trade you need to check out our trading courses. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders. You can also check out the testimonials from our students.Also if you are interested in our day trade alert services and chat room Check them out here.Follow me on Twitter for real time trading setups@szaman and on StockTwits @szamanCheck out our newest Offering "Bulls Vision" ! A brand new screen share product! See through the eyes of@kunal00 while he trades live everyday.[caption id="attachment_48370" align="alignleft" width="800"]

ATRA From blog, strong relative strength. See if it has more.[/caption][caption id="attachment_48371" align="alignleft" width="800"]

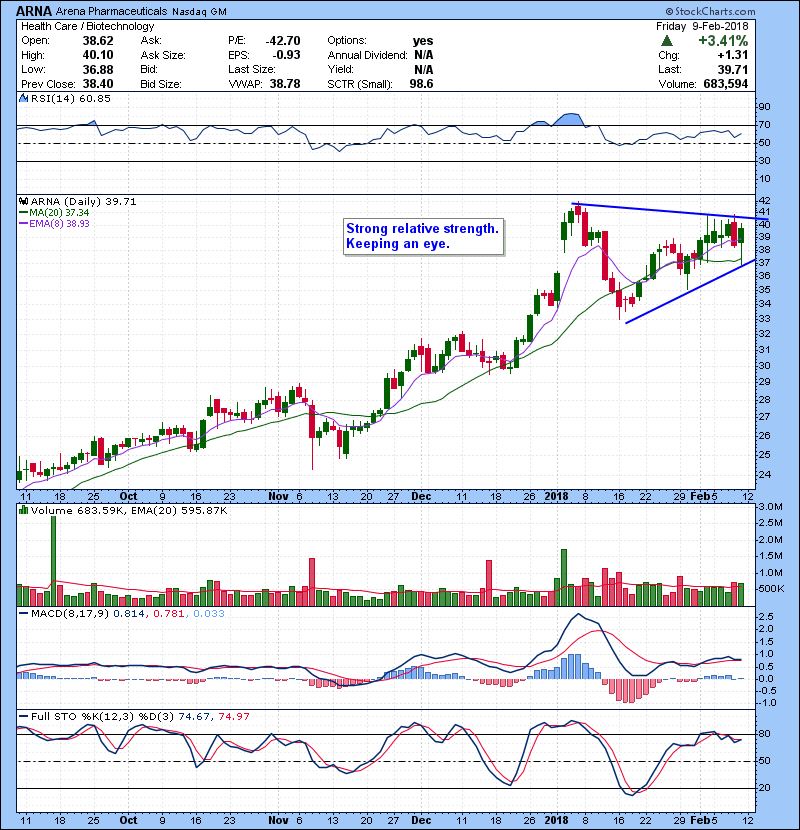

ARNA Strong relative strength. Keeping an eye.[/caption][caption id="attachment_48372" align="alignleft" width="800"]

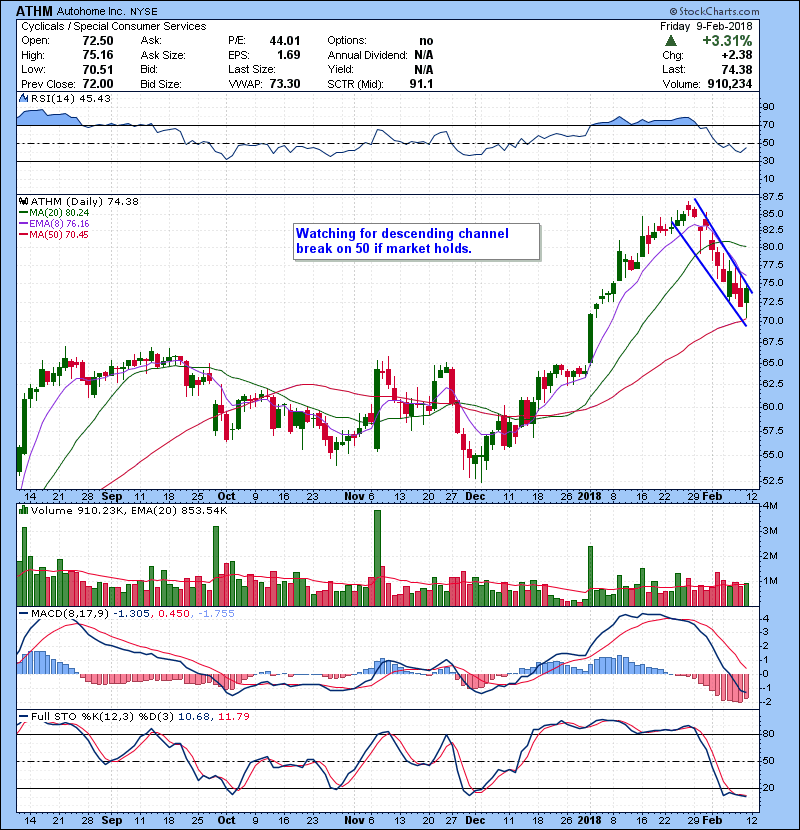

ATHM Watching for descending channel break on 50MA if market holds.[/caption][caption id="attachment_48373" align="alignleft" width="800"]

NFLX Our 20 MA break short worked well. Now needs to get over 20 MA and stay there for a bounce.[/caption][caption id="attachment_48374" align="alignleft" width="800"]

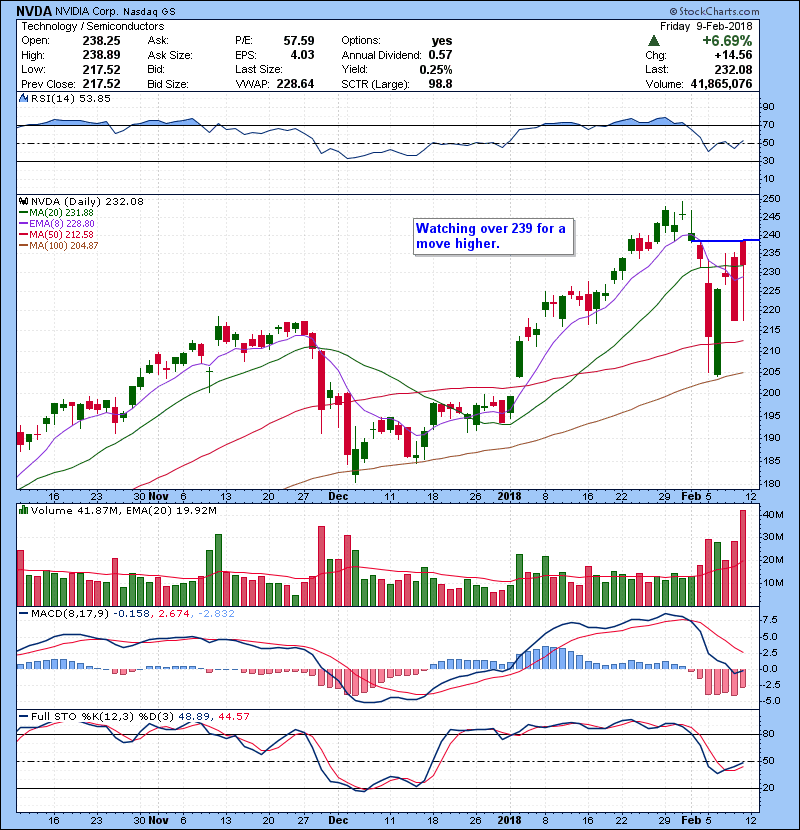

NVDA Watching over 239 for a move higher.[/caption][caption id="attachment_48375" align="alignleft" width="800"]

RIOT Watching over 20 MA for a pop.[/caption][caption id="attachment_48376" align="alignleft" width="800"]

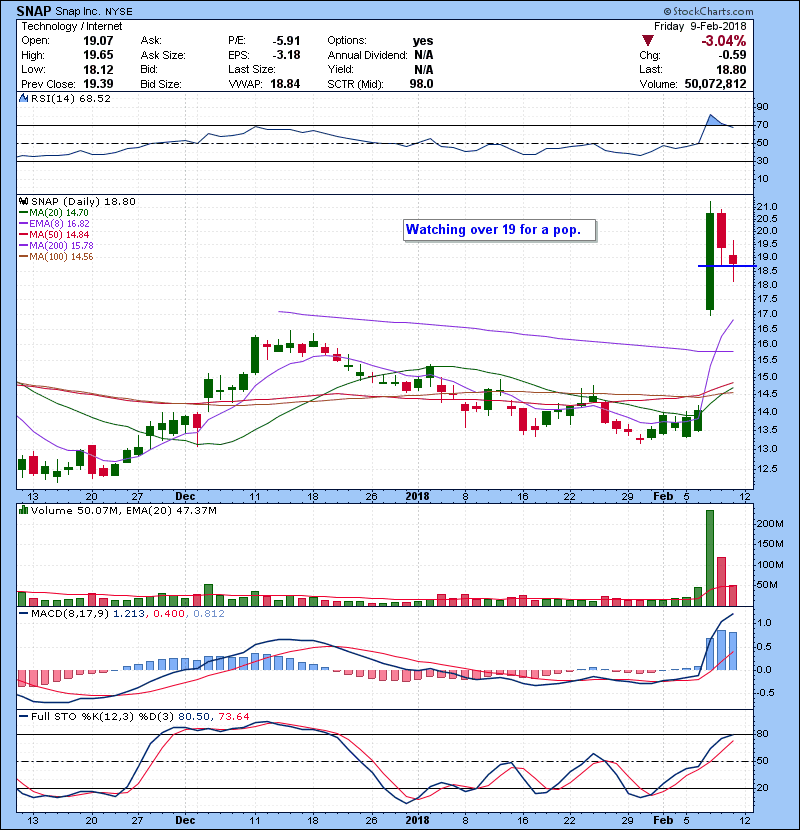

SNAP Watching over 19 for a pop.[/caption][caption id="attachment_48377" align="alignleft" width="800"]

TWTR Holds up well. Watching over 31.70 for a pop.[/caption][caption id="attachment_48378" align="alignleft" width="800"]

WTW Strong relative strength. Holding breakout area. Needs to hold and build here.[/caption][caption id="attachment_48379" align="alignleft" width="800"]

SQ Our 50 MA break short worked well. Back in range. Needs to get over 50 MA for bounce.[/caption]