Quick Summary:

SPY recovers back in range near highs. IWM remounts 20 dma. QQQ lagging. Banks and Biotech strong. Focus list: CYBR, Z, BIDU, FOSL, BITA, SIG, NILE, HABT, ULTA

Video

http://youtu.be/WshtH0ZQYlANote: I highly recommend that you watch the video if you can, rather than just read the notes. I talk about strategies, entries and exits more in depth in the video. I try to make them short and to the point with little non-essential information.

Indexes and Game Plan

All of the major indexes bounced, and SPY completely recovered and is back within it's range near highs. IWM has remounted the 20dma and looks technically sound. QQQ is lagging and still needs to bounce to recover Monday's down move.

Patience is still the best tactic here until we get more clues and better setups.

The game plan is to continue to watch the indexes for clues and keep an eye on this short watchlist. Those looking to trade can look to these stocks.

Today's Trades

My only position is Z which bounced off the hammer today and is back above entry level. The stop for Z is in the $109-110 range.

Sector Watch

IBB is still strong and many of the stocks we are watching still near entries, though I would like some pullback.

Banks are strong and we are now watching 4 bank stocks:

Retail lagged today and still could be a decent short setup. Oil/Energy are trading in a range near bottom, though XLE/DIG is bouncing while crude/USO is not.

RETL,USO,XLE,EDC,IBB,INDL,BRZU,NUGT .

Breakouts

TQNT, ACCO, AMED, TTWO are favorites right now. FOSL has recovered and near good entry level.

With earnings season coming to an end, we continue to watch the attractive earnings breakouts we collected. The good ones are forming ranges and some will become the next momentum players.

TTWO, CALD, COUP ACHC,RFMD,ACCO,AMED,X,TQNT,AN,TRNX,MSG,RCPT,VDSI,BCOR,CATM,BWLD

Focus List

The focus list was strong today. Stocks near entry levels include:

CYBR, Z, BIDU, FOSL, BITA, SIG, NILE, HABT, ULTA

Note that MNST broke below the 20 dma and is no longer a near term entry.

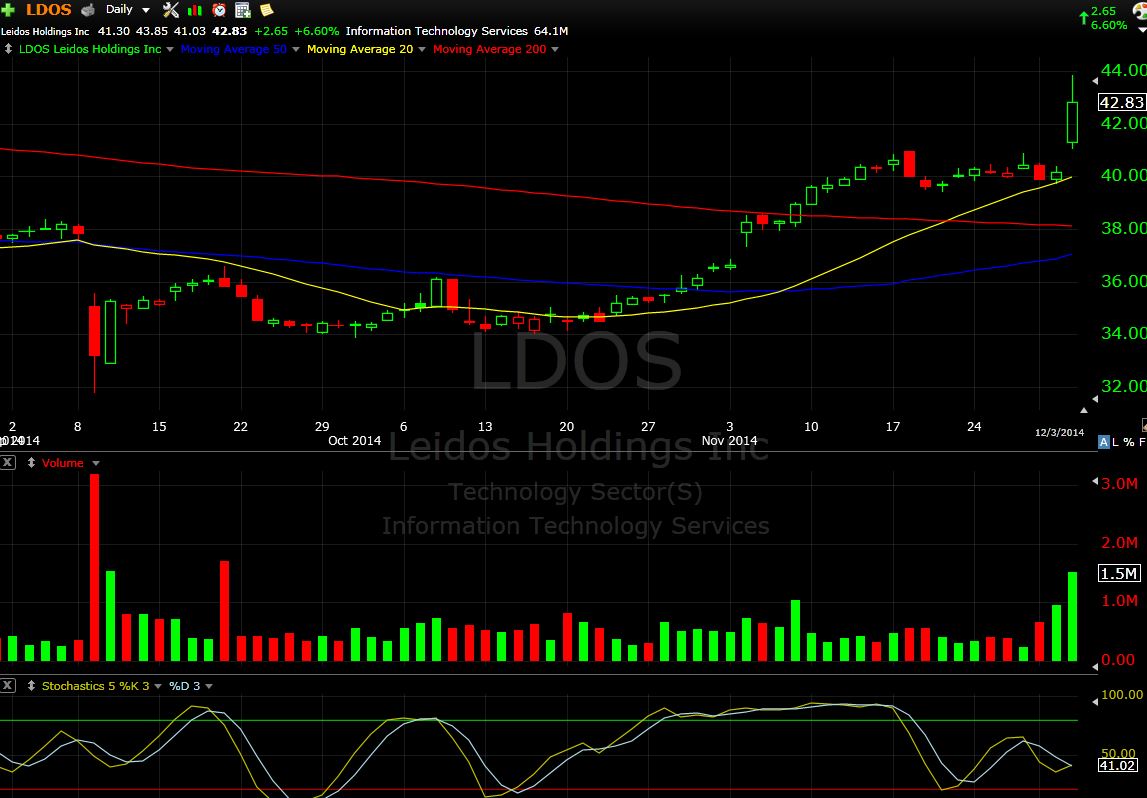

LDOS and GFIG are new additions to the focus list.

LDOS

focus list biotech: ATRA, ESPR, SGMO, MDVN, AGIO, ACHN, RGLS

focus list retail: NILE,TIF,SIG,OUTR,HABT,GES,MUSA,ARO,ULTA

focus list: BITA,TSLA,Z,MNST,SOHU,COUP,SPLK,CYBR,POT,PTX,LMT,MEG,BIDU,GWPH,BABA,VEEV,WUBA

Please read the Education Archive and posts 23 Laws of the Part Time Swing Trading the Market Speculator Way and How to Analyze Your Swing Trade Results It is important to know these setups and rules if you trade off the Report.

New subscribers and trial members please leave me any feedback/comments in the comments, via email (singhjd1@aol.com) or twitter

(twitter.com/PaulJSingh)